Understanding the SME Payroll Process in India

Chosen theme: Understanding the SME Payroll Process in India. Navigate compliance, culture, and month-end routines with practical tips, real stories, and checklists tailored for growing Indian small and medium enterprises. Share your questions and subscribe for upcoming deep dives.

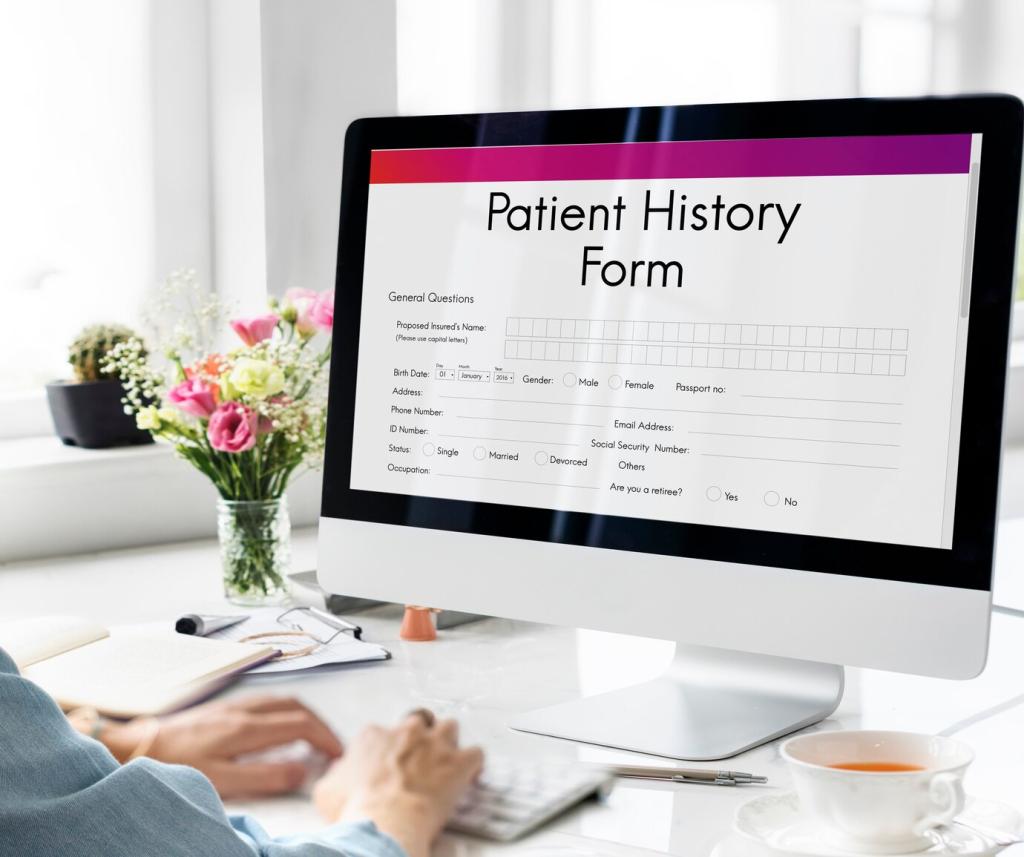

Company and Employee Onboarding Essentials

Begin with PAN, TAN, and bank setup, then standardize employee onboarding: collect Aadhaar and PAN, verify bank details, capture nominations, and generate or link UAN. Use Form 11 for PF status, maintain digital KYC, and document role, grade, and location for state-wise compliance.

CTC, Gross, and Net: Getting the Structure Right

Define CTC transparently, segmenting basic, HRA, special allowance, and statutory contributions. Align with minimum wages and state rules, decide PF and ESI applicability, and document policies for bonuses, reimbursements, and variable pay. Clear structure reduces disputes and ensures predictable, compliant calculations every month.

Provident Fund and ESI Nuances

PF typically involves 12% employee and 12% employer contributions on eligible wages, with the employer share apportioned between EPF and EPS subject to the wage ceiling. ESIC coverage generally applies up to prescribed wage thresholds, with current contribution rates near 0.75% employee and 3.25% employer. File ECR and ESIC returns timely.

Income Tax and TDS Under Old vs New Regime

Capture employee regime declarations, track exemptions or deductions via Form 12BB, and compute monthly TDS accurately. Reconcile challans with books, and file Form 24Q through TRACES without mismatches. Invite employees to annual tax sessions; open Q&A reduces last‑minute anxiety and improves data accuracy considerably.

State Levies: Professional Tax and LWF

Professional Tax and Labour Welfare Fund vary by state and slab. Map each employee’s work location, maintain required registers, and schedule state-wise payments. If you operate across multiple states, comment with your locations, and we’ll share a checklist that reflects those specific obligations.

Running Payroll Each Month

Integrate attendance devices or apps to reduce manual errors. Freeze data before processing, validate shift allowances, and apply overtime rules that align with applicable Shops and Establishments or Factories regulations. Publish a friendly, visual summary to managers for quick confirmations before the final run every cycle.

Reconcile TDS ledgers with payroll registers monthly, then prepare Form 24Q statements with accurate PAN data and salary breakups. Deposit taxes and contributions within statutory timelines, and retain acknowledgments. A simple dashboard of due dates can save hours; comment if you want our reminder template.

Collect investment proofs on time, validate them consistently, and finalize projections before issuing Form 16. Match gross, deductions, and tax paid across payroll, accounting, and bank statements. A clean reconciliation invites fewer queries and builds enduring employee confidence in your payroll process.

Apply Payment of Bonus rules where applicable, track gratuity eligibility and funding, and execute Full‑and‑Final settlements with clarity and empathy. Share breakup sheets that list all components and statutory deductions. Invite feedback after closure; continuous improvement thrives on honest employee responses.

Technology and Data Security for Indian Payroll

Evaluate multi‑state compliance, automated PF/ESI/PT calculations, and seamless ECR and return generation. Look for robust audit trails, maker–checker approvals, and configurable salary structures. Ask for sandbox trials to test real scenarios before committing, and involve finance and HR together in the evaluation process.

Technology and Data Security for Indian Payroll

Connect attendance, leave, and expense systems to your payroll engine to eliminate spreadsheets. Use APIs or secure imports, and auto‑reconcile totals with accounting software. Automation reduces manual touchpoints, cuts errors, and frees HR time for higher‑value work like culture, communication, and employee development initiatives.

Stories and Lessons from the Payroll Trenches

A three‑year‑old SaaS firm discovered allowances were misclassified, underpaying PF. After a tough internal audit, they corrected wage definitions, refiled ECRs, and educated managers. Morale rose when leadership owned the mistake. Share your toughest compliance learning—we’ll crowdsource solutions in a future post.

Stories and Lessons from the Payroll Trenches

Frequent manual attendance edits created payroll disputes on the shop floor. By integrating biometric devices and setting a two‑day approval window, discrepancies dropped sharply. Supervisors now get automated digests, and payroll finalization finishes earlier. Want the digest template? Ask below and we’ll share a starter version.

Stories and Lessons from the Payroll Trenches

Confusion over old versus new tax regimes caused anxiety. HR hosted an open clinic, showing sample payslips under both options and guiding declarations. Employees felt empowered to choose. If communication templates would help your team, comment, and we’ll email a neutral, easy‑to‑adapt slide deck.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.